What is Wealthyhack and Why It Matters

Let’s be real for a second money is a huge part of our lives. Whether we like it or not, it decides where we live, what we eat, and even how much peace of mind we carry every day. That’s why learning simple, smart money strategies is not just important it’s life changing. And that’s exactly where wealthyhack comes in.

Wealthyhack is not about becoming rich overnight or chasing schemes that sound too good to be true. It’s about simple and practical ways to save money, make money, and build financial habits that work in real life. Think of it as your best friend in the world of personal finance always guiding you with easy, doable tips for money management, budgeting strategies, and wealth building techniques.

If you’re tired of feeling like money just slips through your fingers, then you’re in the right place. Let’s explore how wealthyhack ideas can help you take control of your finances and set yourself up for a future that feels secure, exciting, and yes wealthy in the real sense through smart financial planning and debt management.

Why Small Money Hacks Can Change Your Life

Here’s the thing big financial wins are built on small daily decisions. You don’t need to start with millions. You just need to start with what you have today. That’s the heart of every wealthyhack strategy focused on financial literacy and smart money moves.

Imagine saving just a few dollars every day through budget optimization and expense tracking. At first, it feels like nothing, but over a year, it becomes real money. Now imagine putting that money to work through investments, passive income streams, or side hustles. That’s when you begin to see the magic of compound growth and wealth accumulation.

This is not about being cheap or cutting every fun expense. It’s about being smart being aware and making money decisions that support your financial goals instead of holding you back. When you look at wealthyhack strategies this way, it feels less like a burden and more like a lifestyle upgrade toward financial independence.

Wealthyhack and the Power of Saving Smart

We all know saving is important, but let’s be honest—it’s not always fun. That’s why many people avoid it until they feel stuck. The secret is not about saving huge chunks at once. The secret is about building sustainable financial habits and emergency fund planning.

One simple wealthyhack is automating your savings through automatic transfers and payroll deductions. Set a small percentage to move into savings every payday. This way, you don’t even have to think about it. Before you know it, you’ll have an emergency fund that makes you feel secure instead of stressed, following proven savings strategies.

Another great hack is cutting silent money leaks and unnecessary expenses. Subscriptions you don’t use, late fees, impulse purchases, or small splurges that add up. Cancel what you don’t need and redirect that money toward your savings goals and financial planning. These little changes add up faster than you expect through consistent money management.

Turning Side Hustles Into Wealthyhack Gold

Saving alone won’t always create the financial freedom you want. You need extra income streams and multiple revenue sources. Luckily, this is easier today than ever before. That’s where side hustles and freelancing opportunities come into play.

From online freelancing to selling products, affiliate marketing, or even starting a small blog for content monetization, opportunities are endless. The best part is, you can start small and grow as you learn. Think about skills you already have. Can you write? Design? Teach? Each one of these can become a side income stream through skill monetization and the gig economy.

Every extra dollar you make is a chance to build wealth faster through strategic investing and debt payoff. Put it toward paying debts, investing, or funding a dream project. This is one of the smartest wealthyhack moves anyone can make today for income diversification.

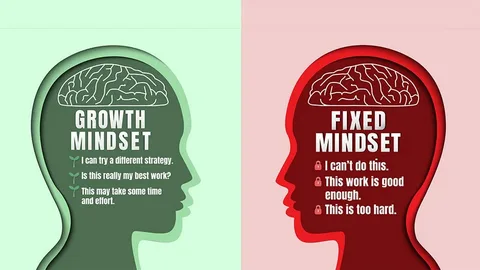

The Role of Mindset in Wealthyhack Success

Money hacks won’t help much if your financial mindset is not aligned. The way you think about money decides how you use it. That’s why the wealthyhack approach focuses on more than just numbers—it’s about your money psychology and wealth mindset too.

Instead of thinking, “I can’t afford this,” try asking, “How can I afford this without hurting my financial goals?” This small shift pushes your brain to find solutions instead of shutting down. This represents positive thinking and financial confidence building.

Believing you can improve your financial life is step one. Wealthyhack ideas are just tools, but the driver of change is always your belief in growth and financial empowerment.

Investing: The Wealthyhack That Builds Future Security

If savings protect you today, investments build your tomorrow through long-term wealth building. That’s why wealthyhack is not complete without talking about investing and portfolio management.

Investing sounds scary to many people, but it doesn’t have to be. Start with simple options like index funds, mutual funds, or retirement accounts such as 401k planning and IRA contributions. Even small monthly contributions grow significantly over time thanks to compound interest and dividend reinvestment.

Real estate investing, stock market participation, or even small business investments can also play a role as you grow. The key is to start small, stay consistent with dollar-cost averaging, and avoid risky decisions that sound like shortcuts through proper risk management.

Avoiding the Traps That Kill Financial Growth

Let’s be honest—there are traps everywhere when it comes to money. Credit card debt, flashy purchases, lifestyle inflation, or quick-get-rich schemes. Falling into these can destroy years of progress in your wealth building journey.

One important wealthyhack principle is learning to say no and practice delayed gratification. Not every deal, purchase, or investment is good for you. Be selective. Focus on things that bring long-term value and align with your financial priorities.

Another trap is lifestyle inflation and keeping up with the Joneses. As you make more money, it’s tempting to spend more. But the smartest wealthyhack is keeping your expenses steady while your income grows through expense control. That way, your wealth builds much faster through the savings rate optimization.

Wealthyhack and the Path to Financial Freedom

At the end of the day, wealthyhack is not about numbers—it’s about freedom. It’s about waking up and knowing you’re in control of your money instead of money controlling you. This represents true financial independence and economic security.

Financial freedom doesn’t mean never working again. It means having choices through financial flexibility. Choices to work because you want to, not because you have to. Choices to travel, to support your family, and to live with peace of mind through financial security.

And that’s the goal we’re all after, right? To live fully, without financial stress holding us back, achieving true wealth creation and financial wellness.

Final Thoughts on Wealthyhack

Money doesn’t have to be complicated. You don’t need a finance degree to take control of your life through financial education. You just need to start with simple wealthyhack ideas and stay consistent with your money management plan.

Save smart through automated savings, earn extra through income generation, invest wisely with diversified portfolios, and keep your mindset focused on growth and financial success. Step by step, you’ll see your financial confidence grow. And trust me, when you feel in control of your money, every other part of life feels lighter too.

So, here’s the challenge: pick just one wealthyhack today and start using it. Watch how small steps turn into big changes over time through the power of compound habits and consistent action. Your future self will thank you for starting right now on this journey toward financial prosperity and money mastery.